China Is Catching Up in R&D—And May Have Already Pulled Ahead

R&D investment drives U.S. competitiveness, but China has likely overtaken America, especially in light of recent cuts to federal science spending under the Trump administration.

Recently published data from the Organization for Economic Cooperation and Development’s Main Science and Technology Indicators show that U.S. growth in gross domestic expenditures on R&D (GERD) is slowing, while China’s has remained relatively high and stable. In three key categories of R&D that contribute to GERD, U.S. spending growth is now only a fraction of China’s. Even when adjusted for GDP, China’s growth still exceeds that of the United States. At this rate, China will soon surpass the United States in gross R&D investment. To reverse this trend, policymakers should restore full R&D expensing and increase R&D tax credits to encourage more private-sector investment. Congress should also award five-year research grants to universities and government laboratories to boost public-sector R&D spending.

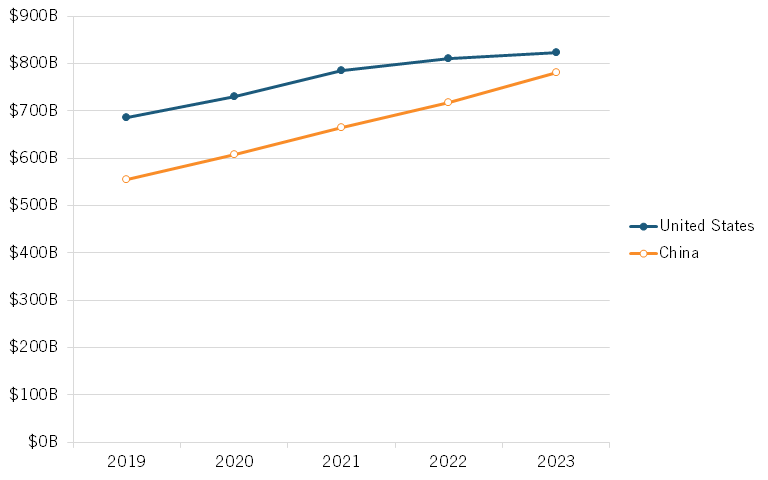

Despite outspending China on R&D, the United States’ GERD growth is slowing, while China’s remains relatively stable and high. In 2023, U.S. GERD totaled $823 billion compared to China’s $781 billion. Yet the United States’ year-over-year growth has declined, resulting in average growth of just 4.7 percent from 2019 to 2023. In contrast, China’s steady growth over the same period produced an average increase of 8.9 percent. As such, U.S. R&D growth is now only a fraction of China’s, signaling that China is rapidly catching up in R&D investments. (See figure 1.)

Figure 1: The United States and China's gross expenditures on R&D from 2019 to 2023

Moreover, because Chinese R&D is less expensive than U.S. R&D, China likely already conducts more R&D activity than the United States. According to an ITIF report, “for every U.S. R&D worker supported by $100,000 of R&D spend, a Chinese firm spending $100,000 on R&D can throw 2.3 workers at the [same] problem.” In other words, when adjusted for cost-efficiency, China’s R&D spending in 2023 was 2.3 times its actual amount—closer to $1.8 trillion. Meanwhile, the United States only spent $823 billion.

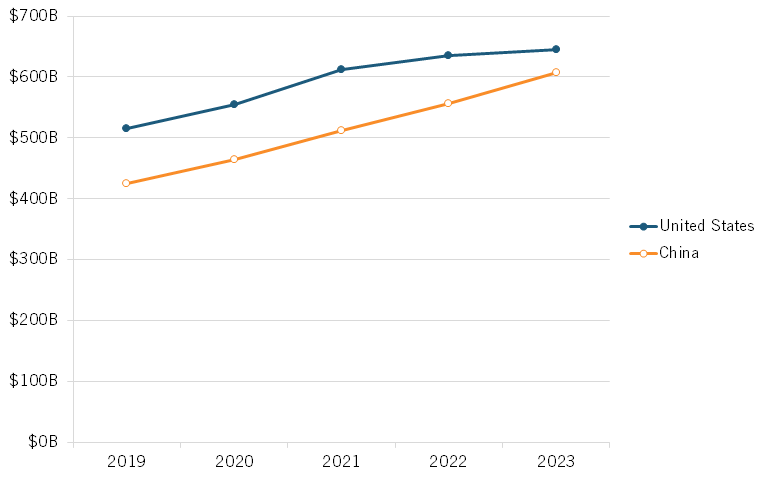

Similarly, while the United States continues to outspend China in business enterprise expenditure on R&D (BERD), its growth has slowed and now trails behind China’s. In 2023, U.S. BERD totaled $646 billion, compared to China’s $607 billion. Despite exceeding China in overall spending, the United States’ year-over-year growth in BERD has declined, resulting in an average growth of just 5.8 percent from 2019 to 2023. China’s growth, by contrast, has remained about the same, leading to an average growth of 9.3 percent over the same period. As a result, the BERD gap between the two nations is narrowing rapidly. (See figure 2.)

Figure 2: The United States and China's business enterprise expenditure on R&D from 2019 to 2023

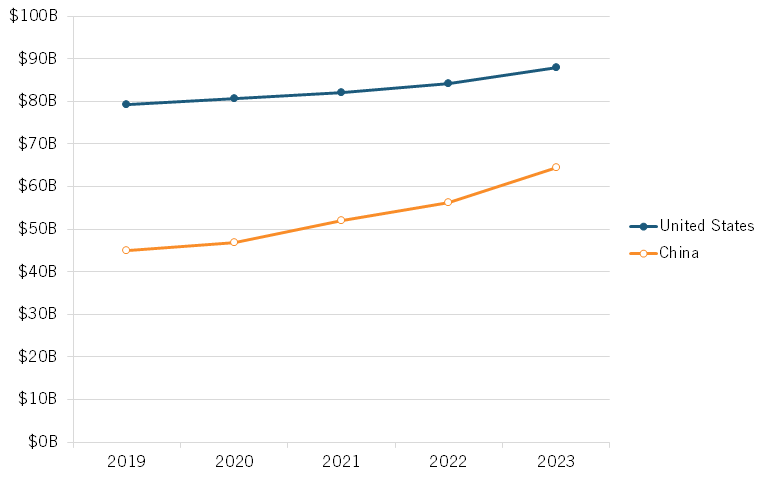

The United States’ higher education expenditure on R&D (HERD) is also higher than China’s, but its growth is still only a fraction of China’s. In 2023, U.S. HERD totaled $88 billion compared to China’s $64 billion. Yet China is rapidly closing the gap. While the United States’ year-over-year growth rate increased from 2019 to 2023, its average growth rate during that period was only 2.7 percent, a fraction of China’s 9.3 percent. (See figure 3.)

Figure 3: The United States and China's higher education expenditure on R&D from 2019 to 2023

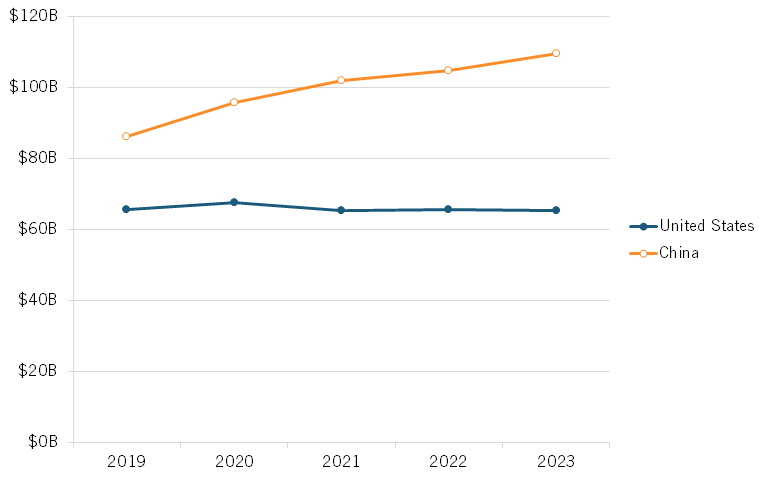

Unlike GERD, BERD, and HERD, the United States’ government intramural expenditures on R&D (GOVERD), or R&D spending within the government sector, and its growth were both lower than China’s. In 2023, the Chinese government sector spent $110 billion on R&D, while the U.S. government sector spent just $65 billion. More concerning, the United States is not attempting to catch up to China. From 2019 to 2023, U.S. year-over-year growth in GOVERD declined and was negative in some years, resulting in an average growth rate of -0.1 percent. China’s year-over-year growth also declined, but it nevertheless achieved a positive average growth rate of 6.2 percent. (See figure 4.)

Figure 4: The United States and China's government intramural expenditure on R&D from 2019 to 2023

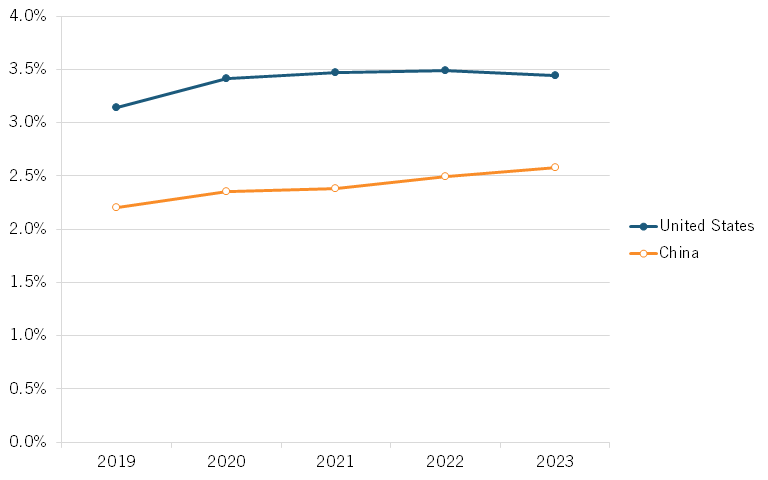

Even when controlling for GDP, China is still rapidly closing the gap with the United States in R&D spending. From 2019 to 2023, both the United States and China saw declines in gross domestic expenditures on R&D (GERD) as a share of GDP—but the United States’ decline was more significant. Over this period, China’s average growth rate was 4 percent, compared to just 2.3 percent for the United States. (See figure 5.) This indicates that China’s growth in GERD is not solely due to its expanded GDP but a deliberate effort to increase R&D investment and catch up to the United States.

Figure 5: The United States and China's gross domestic expenditure on R&D as a share of GDP from 2019 to 2023

Policymakers should restore full expensing of R&D expenditures by passing the Tax Relief for American Families and Workers Act of 2024. Doing so would reduce the after-tax cost of R&D investments and incentivize businesses to allocate more money toward research and development. Additionally, Congress should double the R&D tax credit—from 20 to 40 percent for the regular credit and from 14 to 28 percent for the Alternative Simplified Credit—to further incentivize businesses to increase their investments in R&D. Congress should also set a goal to expand federal R&D at least 1 percentage point faster than nominal GDP growth.

Taken together, these measures would significantly increase total U.S. R&D expenditures, strengthening America’s competitiveness against China, which is especially urgent. As ITIF’s Hamilton Index shows, China is rapidly overtaking the U.S. in production across many advanced industries. If the United States wants to remain competitive and keep its market share in these industries, it must act now to incentivize R&D investment.