How R&D Keeps Businesses Alive and Economies Growing

Firm closures can play a key role in creative destruction and innovation. However, too many firm closures, especially for the wrong reasons, can mean fewer jobs, lower spending, and slower growth. Research and development (R&D) can help prevent closures by boosting productivity, competitiveness, and resilience.

Data from the World Bank’s Entrepreneurship Database and the Organization and Economic Cooperation and Development’s (OECD) Business Enterprise Expenditure on R&D shows that nations with businesses that spend more on R&D experience fewer firm closures. As such, policymakers should incentivize businesses to invest more in R&D if they want to see industries succeed and grow, boosting the overall economy. For instance, U.S. policymakers should restore R&D expensing while also expanding the R&D tax credit to incentivize large and small firms to invest in R&D.

R&D investments can reduce business closures because they increase firm productivity and sales. As a paper by Tang and Wang notes, R&D investment has historically been considered critical to a firm’s productivity because it improves its technological capacity to apply new ideas and innovate. Empirical literature confirms this idea, showing that R&D investments are key to increasing productivity and reducing firm exit, which boosts a nation’s economy:

▪ A paper by Griliches found evidence of a positive effect of R&D investments on productivity. As a result of higher productivity, firms investing more in R&D are also more likely to survive in the economy.

▪ A study by Madrid et al. found a negative relationship between R&D expenditures and exit probability, indicating that an increase in R&D investments reduces the probability that a firm will exit.

▪ A study by Guillin also found that investing in very high levels of R&D increases a firm’s chance of survival.

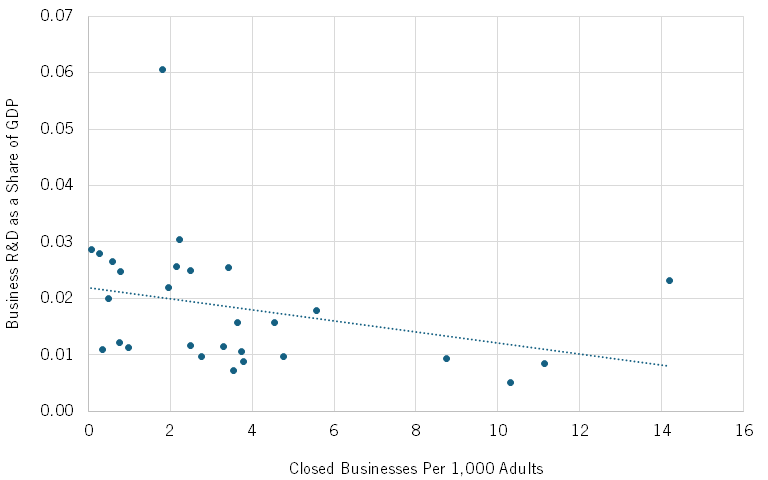

ITIF further corroborates these findings using data from the World Bank’s Entrepreneurship Database and OECD’s Business Enterprise Expenditure on R&D database. Using available data on 28 nations, we found a negative correlation coefficient of -0.31 between closed business density—defined as deregistered firms per 1,000 working-age people—and business R&D expenditures as a share of GDP in 2021. (See figure 1.) In other words, when controlling for national size, countries in which firms spent more on R&D tended to experience fewer business closures.

Figure 1: Correlation between closed businesses per 1,000 adults and business R&D as a share of GDP in 2021 (all nations with available data)

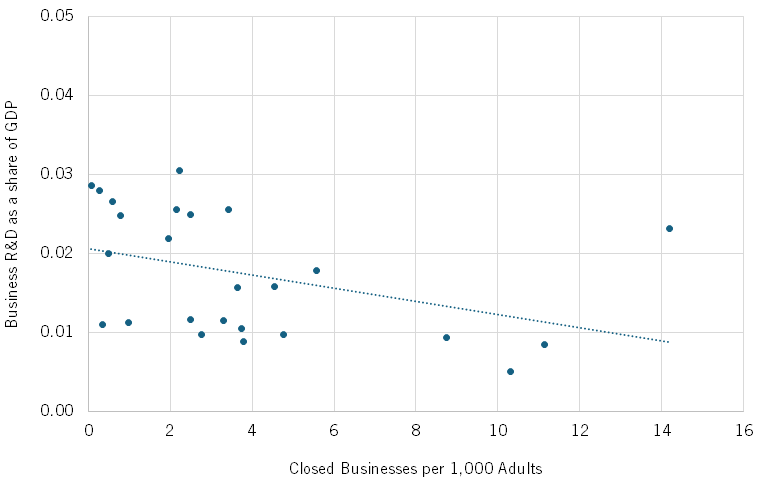

Moreover, the correlation is even stronger when only OECD nations are included. Using available data for 25 OECD countries, we found a negative correlation of -0.39 between closed business density and business R&D as a share of GDP. (See figure 2.) This suggests that firm investment in R&D is critical for survival in OECD economies. However, it is important to note that correlation does not imply causation.

Figure 2: Correlation between closed businesses per 1,000 adults and business R&D as a share of GDP in 2021 (OECD nations with available data)

Policymakers should incentivize firms to invest more in R&D if they want to see businesses succeed and grow in the economy, which will lead to more jobs, a better living standard, and a better overall economy. Many policy tools are available to incentivize firms, but each nation should choose the best fit for them. For example, policymakers can implement an R&D tax credit or increase existing ones. In less developed countries, policymakers can enact stronger intellectual property protection and regulations to safeguard firms that invest in R&D and bring new products to the market.

In the case of the United States, policymakers should pass the Tax Relief for American Families and Workers Act of 2024 to restore R&D expensing. Meanwhile, Congress should double the R&D tax credit from 20 to 40 percent for the regular credit and 14 to 28 percent for the Alternative Simplified Credit. As a result, these steps will incentivize U.S. firms to increase R&D spending, boosting the American economy and its global competitiveness.

This is not to say that a nation should have zero firm closures—less productive businesses should exit the market. However, if a nation incentivizes firms to invest in R&D, the ones that can become increasingly productive should remain in the market, boosting a nation’s economy.